Corporate Transparency Act: Is Your Business Ready for the January 1, 2024 Effective Date?

With 2023 year-end approaching quickly, companies should review the requirements on the Corporate Transparency Act (CTA) and prioritize identifying their compliance obligations in anticipation of the CTA’s upcoming effective date, January 1, 2024.

The CTA was adopted in 2021 as part of the National Defense Authorization Act of 2020. Dissecting the statutory requirements has been a task. However, as the effective date draws near, FinCEN has released further clarification on some of the reporting requirements and processes. Now is the time for companies to finalize their preparedness plans before reporting begins.

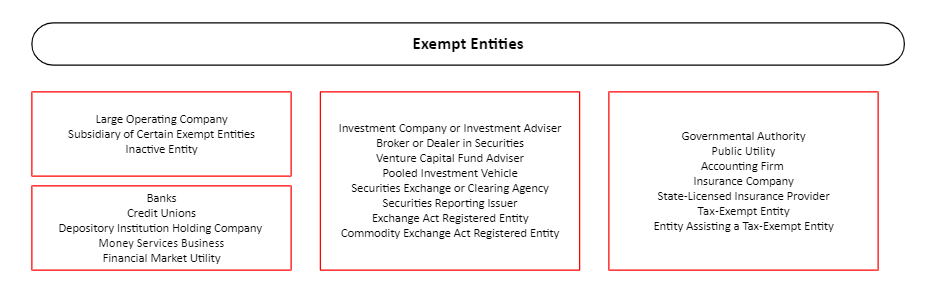

FinCEN recently released its “Small Entity Compliance Guide” (the “Guide”). The fifty-six-page Guide offers insight regarding the types of entities that are subject to beneficial ownership reporting, which is the first analysis to be completed when assessing whether the CTA applies to a company. Below is a diagram highlighting exempt entities:

Although there are various types of exempt entities, one of the most notable exemptions is for large operating companies.

A large operating company meets all of the following criteria:

- Employs more than 20 full-time employees (“full-time” means the employee works an average of 30 hours per week)

- More than 20 full-time employees are employed in the United States

- Has an operating presence at a physical office in the United States

- Can prove more than $5,000,000 in gross receipts or sales in the previous tax year that can be substantiated on relevant IRS forms

- Gross receipts or sales meeting the $5,000,000 threshold is generated from business conducted in the United States

The Guide is particularly helpful because it includes checklists and decision trees to determine whether a company falls under one of the reporting exemptions. For example, the Guide addresses whether smaller subsidiaries that would typically be subject to CTA reporting are exempt because of a certain exempt entity parent, how certain rules may affect affiliated entities, whether a trustee of a trust or similar arrangement may exercise substantial control over a reporting company, and more.

Despite the insight the Guide provides, questions will likely remain for many business owners.

Under the CTA, non-exempt entities must report the following on “beneficial owners” and for those non-exempt entities formed after January 1, 2024, the same must be reported for “company applicants”:

- The individual’s full legal name

- Date of birth

- Current residential or business street address

- A unique identifying number from an acceptable identification document (e.g., a passport)—or the individuals FinCEN identifier

Once a company identifies the information it must report, it should implement a reporting procedure, including whether certain individuals should apply for a “FinCEN identifier." This identifier can relieve the burden of reporting the same information repeatedly, especially if a beneficial owner is involved with several reporting companies. Earlier this month, FinCEN issued a final rule that provides certain criteria that must be met for a reporting company to request a FinCEN identifier.

Technical specifications for the reporting portal have not been released in full and this uncharted territory presents potential cybersecurity and data privacy concerns. Companies should be wary of potential imposters offering to assist with beneficial ownership information reporting or compliance.

Those considering forming a new entity should seek counsel to work through the timing and reporting requirements. Existing clients may benefit from a general consultation regarding CTA reporting as well. In either case, a member of Butzel’s corporate team is available to discuss your reporting obligations and best practices to ensure compliance.

Laura E. Johnson

248.593.3014

johnson@butzel.com

Joseph Kuzmiak

313.983.7497

kuzmiak@butzel.com

Shanika A. Owens

313.983.6908

owens@butzel.com