Major Changes to Qualified Small Business Stock (QSBS): How Investors Can Benefit

Recent changes to the IRC Section 1202 Qualified Small Business Stock (“QSBS”) rules offer investors and founders potentially significant additional tax savings, which may affect choice of entity decisions and trigger updated planning considerations.

Background: What is QSBS?

QSBS allows for a federal capital gains tax exclusion that rewards early investment in startups and small businesses.

To qualify, QSBS must be:

- Issued by a domestic C corporation;

- Acquired at original issuance (not on the secondary market);

- Issued when the company’s gross assets are below $50 million (now increased);

- Held for at least five years, with some limited flexibility allowing for tacked holding periods (now reduced);

- Conduct of an active trade or business is required. Service based businesses, including finance, accounting, and law, are excluded.

Prior to the most recent changes, QSBS offered qualifying investors the ability to exclude from taxable income the greater of: (i) $10 million, or (ii) ten (10) times an investors basis in the stock.

How the One Big Beautiful Bill Act (“OBBBA”) Improves on the Benefits of QSBS

On July 4, 2025, President Trump signed into law the OBBBA, which enhances QSBS in three major ways:

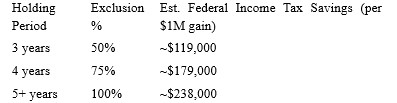

1. Shorter Holding Periods for Partial Exclusion. QSBS issued after July 4, 2025 now benefits from tiered gain exclusion based on length of holding period:

This tiered structure rewards earlier liquidity events, making M&A exits, redemptions, or secondary sales more appealing even before the traditional five-year mark.

2. Increased Gain Exclusion Cap. For post-OBBBA issued stock, the exclusion cap is raised from $10 million to $15 million per taxpayer per issuer, indexed for inflation starting in 2027. This creates greater upside potential for outsized exits and allows for expanded use of QSBS stacking strategies using trusts and family members.

3. Higher Gross Asset Limit. The gross assets test is increased from $50 million to $75 million, expanding eligibility for growth-stage companies that would have previously been excluded. This especially benefits companies raising larger Series B/C rounds or scaling post-product market fit.

Timing Is Everything

If you’re planning a funding round, granting founder shares, exercising options, or converting a SAFE or convertible note, the timing of that issuance is now a critical tax decision.

Startups preparing equity grants, early-stage investments, or SAFE/convertible note conversions may consider deferring issuances to occur on or after July 4, 2025, if practical.

How We Can Help

Our attorneys routinely advise on all aspects of QSBS strategy and implementation. We can help you:

- Evaluate current cap tables and upcoming issuances for eligibility;

- Structure future investments to maximize QSBS benefits;

- Draft compliant equity documents and stock grant agreements;

- Model potential tax outcomes.

To discuss how the new QSBS legislation may impact your fund or portfolio, please contact the authors of this Client Alert or your Butzel attorney.

Daniel Soleimani

248.258.2606

soleimani@butzel.com

Maria Sesi

248.593.2099

sesi@butzel.com