Major Changes to Michigan Paid Sick Leave and Minimum Wage May be Coming in Wake of Court Decision

On July 19, 2022, the Michigan Court of Claims issued a decision that effectively replaces the current Michigan Paid Medical Leave Act with a different, more burdensome version of the law that would require all Michigan employers, regardless of size, to offer paid sick leave to employees. The decision would also increase minimum wage to $12 per hour and begin phasing out the tip credit utilized by the hospitality industry. In short, if the Court of Claims decision stands, it will drastically impact Michigan businesses and require employers to quickly re-do sick time and payroll policies.

What happened?

In 2018, the Michigan Legislature passed the Earned Sick Time Act (ESTA) that was set to be on the ballot and provide up to 72 hours of sick time for all Michigan employees. In the same session, the Legislature amended the law to the far less restrictive Paid Medical Leave Act that applied only to larger employers. The Legislature used the same technique (often referred to as the “adopt-and-amend” strategy) in passing an increased minimum wage proposal that it later amended to provide smaller minimum wage increases. Yesterday, the Court of Claims ruled that the amended laws are invalid, and the original statutes are in effect.

What is the Earned Sick Time Act?

Under the Earned Sick Time Act that will, absent an appeal, go into effect, employees earn a minimum of one hour of sick time for every 30 hours worked. All full-time and part-time employees will be entitled to 72 hours of sick time in a year (unless the employer selects a higher limit). However, employees of “small businesses,” (employers with fewer than 10 employees) may only accrue up to 40 hours of paid sick time and 32 hours of unpaid sick time each year unless the employer selects a higher limit. Earned sick time will carry over from year to year up to the annual maximums. An employer’s paid leave policies that provide leave in at least the same amounts required by the act will be considered compliant with the ESTA.

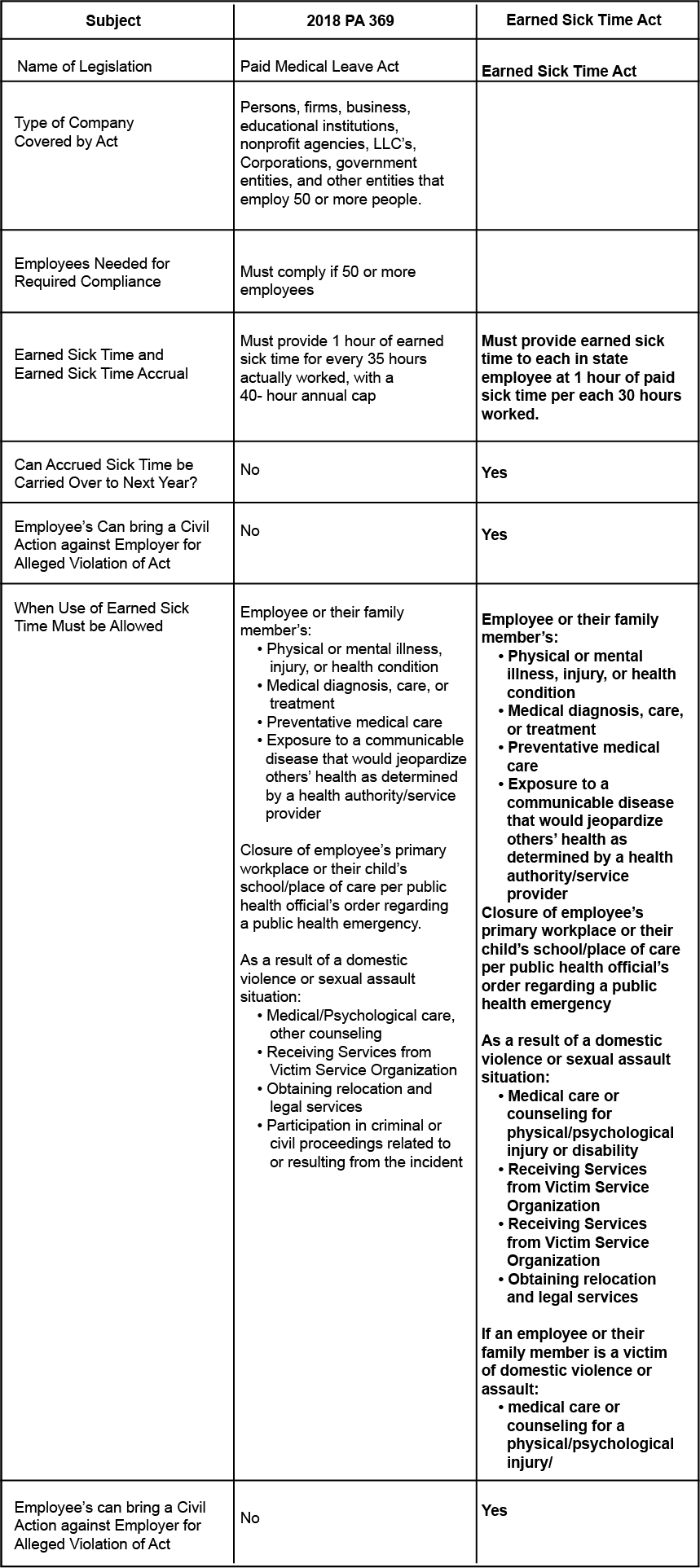

Importantly, ESTA prohibits employers from “retaliating” against an employee for engaging in activity protected by the act. Importantly, there is a rebuttable presumption that an employer violated the act if it takes any adverse personnel action against an employee within 90 days after the employee engages in protected activity. Read broadly, this may create potential liability for employers who need to terminate employees within 90 days of their use of a sick day. A summary of the differences between these laws can be seen in the below table.

Amendments from 2018 PA 369 Compared with Soon to Be Effective (in bold) Paid Medical Leave Act

What might change with Michigan’s minimum wage and tip credit?

If the Court of Claims decision stands, under the original version of the 2018 Improved Workforce Opportunity Wage Act, Michigan businesses may have to quickly raise minimum wage to $12 per hour with annual adjustments for inflation. Further, for the hospitality industry, the tip credit for employees will be phased out. According to the law, tipped employees would have to earn 80% of the minimum wage in 2022 with the tip credit completely phased out by 2024. The law further requires disclosure to customers regarding the distribution of service changes.

When will these changes take effect?

Generally, unless an appeal is filed, the ruling will go into effect within 21-days following the entry of judgment. That means that these changes could occur in mid-August. Additional appeals and litigation are expected to follow this decision and employers should stay tuned. In the meantime, feel free to reach out to your Butzel attorney with any questions.

Brett Miller

313.225.5316

millerbr@butzel.com

Sarah Nirenberg

248.258.2919

nirenberg@butzel.com

Kurtis Wilder

313.983.7491

wilder@butzel.com

Daniel McCarthy

248.258.1401

mccarthyd@butzel.com

Christine Santourian

313.983.7497

santourian@butzel.com