Employees with Benefits

Like employers everywhere, the education industry is struggling to attract talented employees. The much talked about “Big Resignation” hit the education industry particularly hard, in part because their employees can often retire early with a healthy nest egg in their retirement plans, and they will have access to affordable retiree health care. Generous retirement benefits allow employees to retire early. Yet, education industry employers often fail to leverage the very attractive employee benefits that they provide, to use them to their advantage when working to attract new employees. To paraphrase a line from The Producers, “When you got it, flaunt it!”

Building a Better Mousetrap

During the interview process, many employers mention the employee benefits they provide only near the end of the interview process, and even then, they might describe the benefit package in general terms – “good,” or “generous,” or “comprehensive.” This does little to convince an applicant that they’ll have a better quality of life if they take the job. More to the point, it does nothing to attract solid candidates to apply for the job in the first place. Education industry employers need to change the focus of their narrative if they want to draw talent away from commercial businesses.

In 1971, the advertising agency JS&A printed a full-page ad in the Wall Street Journal explaining to the general public why they needed to buy a Texas Instrument pocket calculator. Relatively few people had ever heard of a pocket calculator before that point, let alone purchased one. The ad shunned brief catchphrases and read more like an article about a new scientific invention that would improve lives. It is widely touted as the one of the most successful campaigns for a new product, leading to a full-scale war of evolution in the fledgling pocket calculator market. Simply put, the ad changed people’s minds by carefully explaining the advantages of a pocket calculator over an adding machine.

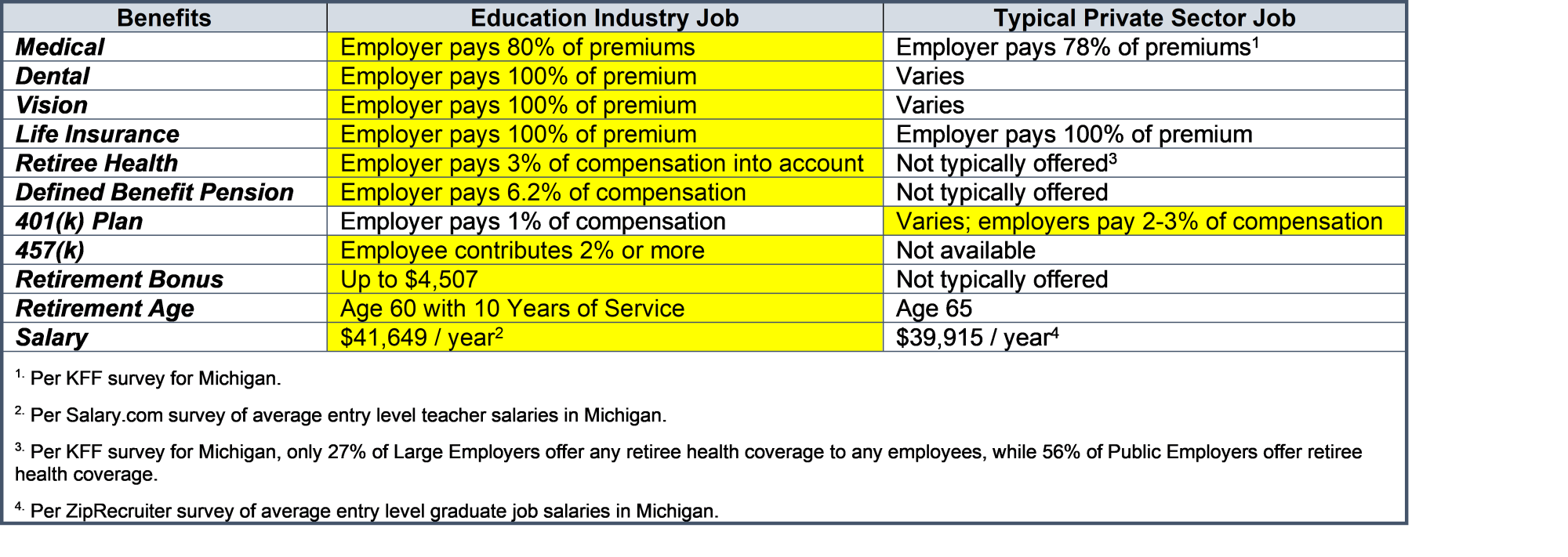

Changing minds is never easy but lining up the facts in your favor and sharing them with the target audience is an important step in that process. To see what this might look like in the context of attracting college-educated employees to work in the education industry, let’s look at some hypothetical facts drawn from an actual collective bargaining agreement from an education industry employer in Michigan.

Assume that an education industry employer provides:

- Medical. The employer pays 80% of the total annual costs including the premiums, co-pays, and deductibles. (This is the maximum permitted under the Public Act 152 of 2011 "hard caps.")

- Dental, Vision, Life insurance, and Long-Term Disability. The employer pays 100% of the premium for these coverages.

- MPSERS Retirement Benefits (Michigan Public School Employees Retirement System):

- New employees become a member of the Pension Plus 2 plan if hired after February 1, 2018 and they elect this plan. The employee makes pretax contributions to the pension fund equal to 6.2% of compensation, and the employer makes an equal contribution.

- The Defined Contribution (DC) component of the plan provides a 50% employer match on the first 2% of employee compensation contributed. These employee contributions are placed in the Pension Plus 457 Plan or the Pension Plus 2 457 Plan and the employer match contributions are put into the Pension Plus 401(k) Plan or the Pension Plus 2 401(k) Plan.

- Retiree Healthcare. Employees automatically contribute 4% of compensation to a Personal Healthcare Fund. The employer provides a 100% match of the first 2% contributed, and a 50% match on the next 2% contributed. All amounts are invested, and not taxed when used.

- Retirement Age. Currently Age 60 with 10 years of Service. This can increase with life expectancy increases, but not if you are within 5 years of retirement.

- Retirement Bonus. Upon reaching retirement age under the Michigan Public School Employees Retirement Act and having completed at least fifteen (15) years of service with the employer, the retiring employee receives a lump sum payment for each year of service with the employer at the rate of $150.24 up to a maximum of $4,507.20.

Now compare these benefits to what a typical employer in the private sector provides the same entry-level college graduate employee.

After a side-by-side comparison of the employee benefits offered by an education industry employer versus those provided by typical private sector employers in Michigan, the clearly better compensation package is that of the education industry employer. This financial argument is even stronger when taking into account the average entry-level salaries – the education industry employer pays more than the average public sector employer for an entry-level college graduate position.

Education industry employers can marshal the facts that show that they have more to offer employees and can put those facts to work for them in shaping minds and influencing potential employees.

Attracting Retirees to Work for You

A recent change in the law will also help address the shortage of employees in the education industry: Public Act 184 of 2022 was recently signed into in July. Under the new law, public school retirees who have been retired at least nine consecutive months may return to work in any position at a public school with no effect on their defined benefit pension plan or retiree healthcare benefits. There is also no limit on their annual wages. Periodic distributions being received under a State of Michigan 457 Plan or 401(k) Plan account will be suspended while actively working for a public school.

This change in the law creates a favorable financial setting for retirees to return to work within the education industry. Once again, outreach and communication can be key to attracting retirees to your educational institution.

Conclusion

In a memorable scene from the movie Fried Green Tomatoes, a middle-aged woman who feels invisible rams her car repeatedly into the car of a young flashy girl who stole the parking spot the woman had been patiently waiting for. In response to the looks of astonishment she retorts: “Let’s face it honey. I’m older, and better insured!” Employers in the education industry are not only ‘better insured,’ but they offer richer retirement benefits than the typical commercial employer in Michigan. In order to not be overlooked at the recruiting table, education industry employers should use their strengths – superior employee benefits and better quality of life – as a recruiting tool.

Butzel’s Education Industry team helps its clients navigate the legal, operational and economic issues and relationships inherent to the industry. If you have any questions about this client alert, or other education matters, please contact the author or your Butzel Attorney for further assistance.

Lynn McGuire

734.213.3261

mcguire@butzel.com