USMCA’s July 1 Deadline Looming: Five Major Changes Your Business Needs to be Aware Of

We are a few days away from the United States Mexico Canada Agreement (USMCA) entry into force date of July 1, 2020. Is your business ready to comply with the USMCA new rules of origin? If not, you may still have time to prepare.

The USMCA will have an impact on many industries and even businesses that are not directly engaged in merchandise export/import in North America. Suppliers may come to the realization that their customers’ or suppliers’ operations are relying on inputs that will be subject to the new and enhanced USMCA origination rules. As we’ve seen during the COVID-19 pandemic, U.S. supply-chains are highly integrated and depend heavily on inputs from other countries. A break in one of the supply-chain links could mean disruption and stoppages for the remainder of the supply-chain.

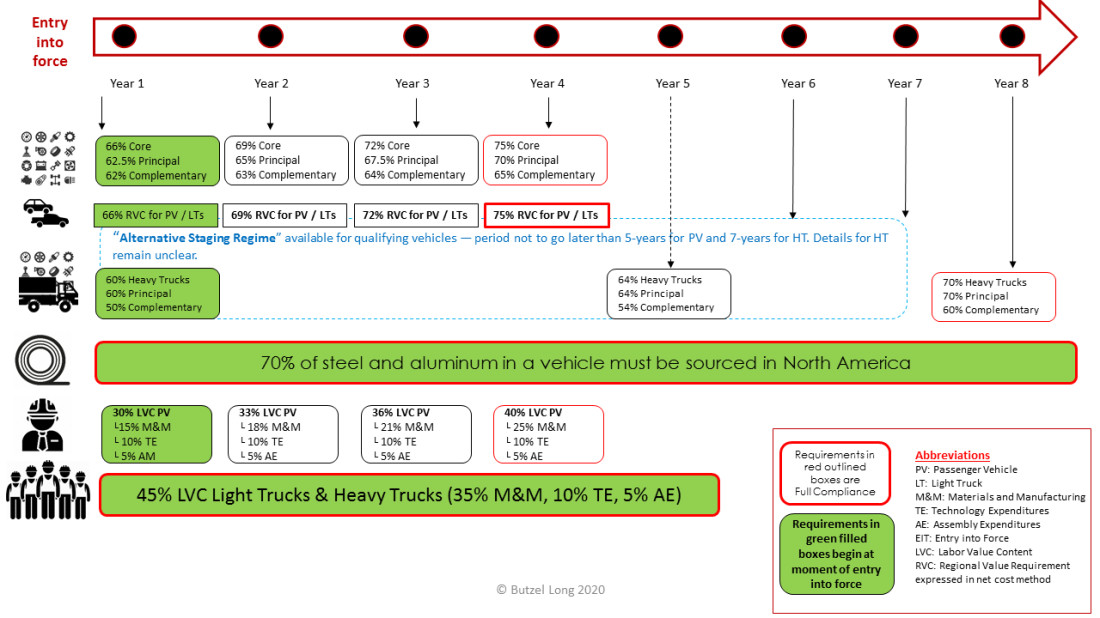

Please note that whenever you see a reference to “origination” or its derivatives, we are referring to the origin of products and their components for purposes of the USMCA. Free-trade agreements, including the USMCA, grant preferential treatment (i.e., duty-free) when the products comply with multiple rules that determine their origin. These rules are usually referred to as rules of origin or origination requirements. For a visual diagram of origination rules to the USMCA please see the figure below (click the image to view a larger version).

Hence, under a free trade agreement, rules of origin are the criteria needed to determine the national source of a good. Think of rules of origin as a safety mechanism intended to make sure that other non-member countries do not take advantage or circumvent applicable duties. Also, take into account that an importer may elect for a product to forego preferential duty treatment in lieu of compliance with the origination requirements. In such cases, standard duty rates (and tariffs) according to the United States Harmonized Tariff Schedule (2020) Revision 12 (“HTS”) will apply.

The updates from NAFTA to USMCA are significant, particularly, for the automotive industry. Do not assume that compliance with the old NAFTA rules equates to automatic compliance with the USMCA. There are some of the major changes that will be implemented on July 1.

1. Elimination of tracing lists and the “deemed originating” loophole. At the time NAFTA was implemented in the early ’90s, vehicle content looked very different from today. The value of vehicle content has shifted to electronics and technology parts. The advent of electric cars will only accelerate this trend even further. Under NAFTA, the intent of tracing lists was to prevent manufacturers from “rolling up” imported content that originates from outside North America. The problem was that the tracing list was never updated to reflect a modern vehicle’s content. Under NAFTA, only items on the tracing lists had to be accounted for, and everything else not on the list was “deemed originating.” This includes, by way of example, batteries, parts of seats, chipsets, sensors, radar/lidar, and steel and aluminum, among other examples. The USMCA effectively eliminates the “deemed originating” loophole that allowed much of modern vehicle content to skirt the regional value requirements under NAFTA. Now, all content will need to comply with the product-specific rules of origin. As a result, some suppliers that never worried about the “origination” of their product might now find themselves in a situation where their product no longer is able to receive preferential treatment after July 1.

2. Tariff Shift Requirements and Increased Regional Value Content Requirements. The USMCA classifies vehicle parts into three main categories; core (super-core) (e.g. engines and transmissions), principal (e.g., glass and tires), and complementary, (e.g. valves and batteries). On average, Regional Value Content “RVC” increased for passenger vehicles and parts thereof from 62.5% to 75%. However, part-specific regional value requirements and tariff shift requirements depend on the classification of each vehicle part as provided by Annex 4-B and its Appendix. To determine the applicable rule of origin for a product, (tariff shift and/or RVC) you will need to know the classification of your product according the Harmonized Tariff Schedule. Calculation of the Regional Value Content hinges on the value of non-original materials. Without getting too much into the weeds, you can lose origination status by adding non-originating materials to your product.

3. New Labor Value Content Requirements. In addition to Regional Value Content requirements described above, the USMCA provides for new Labor Value Content (“LVC”) requirements not previously required by NAFTA or any other free trade agreement. The main purpose of including the LVC requirement is to discourage the outsourcing of manufacturing jobs to low wage plants in Mexico. Under the USMCA, vehicle producers will need to self-certify that their production meets LVC requirements. These requirements state that up to forty percent (40%) of the product’s value in passenger vehicles and up to forty-five percent (45%) of light and heavy trucks must be made in facilities with a production wage rate of at least $16 per hour. The calculation of the production wage is extremely complex and filled with little nuisances (for example, LVC calculation is plant-specific). Vehicle producers will be able to credit materials that are LVC compliant towards their average. Consequently, all things being equal, it is reasonable to assume that vehicle producers will prefer LVC compliant capacity over non-compliant capacity. As a side note, LVC requirements should not be confused for the new enforcement mechanism (rapid-response labor mechanism) that will allow an independent panel investigation at covered facilities to review suspected “denial of the rights” to workers of free association and collective bargaining.

4. New steel and aluminum purchase requirements. In addition to the product-specific rules of origin and Labor Value Content, a passenger vehicle, light truck, or heavy truck will be originating only if, during the prior year, at least 70 percent of the vehicle producer´s purchases of steel and aluminum are considered originating as well. In addition to the purchasing requirement, the USTR took it one step further when the agreement was renegotiated in late December last year. The countries further tightened this rule by adding a requirement that, beginning seven years after the entry into force of the USMCA, steel may only qualify as originating for purposes of Article 6 if “all steel manufacturing processes…occur in one or more of the USMCA countries, except for metallurgical processes involving the refinement of steel additives.

5. Customs Administration and Trade Facilitation. One of the changes that has generated much confusion is that there is no predetermined form for certificates of origin for making preferential treatment claims. Under NAFTA, exporters and producers could issue certificates of origin for their goods to receive preferential tariff treatment. The USMCA will not use a uniform certificate and instead provides that a certification of origin may be provided on an invoice or any other document (except non-party documents) and need not follow a prescribed format, provided that it contains certain minimum data elements. Also, the certificate of origin may now be completed and submitted electronically with an electronic or digital signature. Importers need to exercise great care when relying on either exporter or producer certificate of origin for making preferential duty claims. They could be subject to penalties, duties, and interest for making incorrect statements. When audits occur, the absence of a valid contemporaneous certificate of origin can result in retroactive denial of the USMCA benefits plus penalties.

In addition to being aware of the new changes, it is paramount to understand your contractual responsibilities concerning compliance with new origination requirements. Some contracts may only require suppliers to provide information necessary to ascertain origination criteria under the USMCA, while others may require specific compliance with rules of origin. In any event, it is likely that down the line OEMs will attempt to pass down the new USMCA requirements to their suppliers. OEMs have great flexibility to amend their terms and conditions and as such, this will not be the first time they decide to pass down requirements to their supply base. We have seen this with conflict minerals, tariffs, and even previous NAFTA requirements.

Fortunately, there may still be some time left to assess whether your products comply with the new rules of origin and to make changes. U.S. Customs and Border Protection (“CBP”) recently updated its Interim Implementing Instructions allowing for a measure of discretion in the enforcement of the new rules of origin. CBP will take into account the difficulties importers may face in complying with the new rules, as long as importers are making satisfactory progress toward compliance and are making a good-faith effort to comply with the rules to the extent of their ability. Please note that discretionary enforcement does not mean suppliers are not required to meet origination requirements.

If you are not sure whether your company is compliant or whether your suppliers or customer could be affected by the new rules, we can help you assess your supply chain and prepare a strategy to better meet the new requirements and communicate with your entire supply-chain.

Raul Rangel Miguel

202.454.2841

rangel@butzel.com

Leslie Alan Glick

202.454.2839

glick@butzel.com

Catherine Karol

313.225.5308

karol@butzel.com

Jim Bruno

313.225.7024

bruno@butzel.com

Mitch Zajac

313.225.7059

zajac@butzel.com